Credit is Gold and has more value than CASH.

Your Credit is a Snapshot for creditors to show your ability to pay our debit. Credit can allow you to finance a car, a home, a credit card, or a business. Strong Credit will enable you to buy a property for minimal down-payment and secure a low-interest rate.

Get to know credit cards with these 10 credit terms:

Annual Fee – The once-a-year cost of owning a credit card. Some credit card providers offer cards with no annual fees.

Annual Percentage Rate (APR) – The yearly interest rate charged on outstanding credit card balances.Balance – An amount of money. In personal banking, balance refers to the amount of money in a savings or checking account. In credit, balance refers to the amount of money owed.

Credit Bureau – There are three agencies that collect your credit score., Equifax, Experian, and Trans-union.The Credit Bureaus score you based on different elements, we will discuss later.

Credit Line – The amount a creditor will extend to you when they give you a credit card or a loan of some kind.

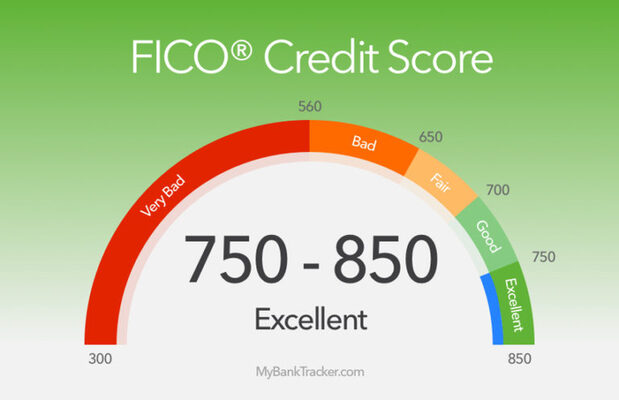

Credit Rating – A financial institution's evaluation of an individual's ability to manage debt. It’s crucial to have a good credit rating if you want to borrow money or apply for a credit card or loan. Learn how to maintain a strong credit score.

Grace Period – The period of time after a payment deadline when the borrower can pay back the borrowed money without incurring interest or a late fee.

Introductory Rate – An interest rate offered by credit card issuers in the initial stages of a loan. These rates are often set much lower than standard rates in order to attract new cardholders. Make sure you know how long the introductory rate will last and what the standard interest rate will be once the introductory period ends.

Minimum Payment – The minimum amount of money that you are required to pay on your credit card statement each month in order to keep the account in good standing.

Below are the things that effect your credit score.

1. Payment History - 35%

Payment history has a pretty big effect on your credit score. It accounts for about 35% of your credit score for each of the scoring models. (The main credit scoring models are FICO and VantageScore). Your payment history is basically the record of whether you’ve paid your bills on time—or not.

Creditors report your payment activity—good or bad—to the major credit bureaus. A single late payment won’t likely hurt your score, especially if it’s a one-time thing. But multiple late payments do affect your score, and the later you are, the more it can impact your credit score. Missing a payment on any debt can affect your credit score negatively, including payments for:

- Credit card bills

- Student loans

- Mortgage loans

- Car loans

Other types of payments, such as your utilities or phone bill, don’t typically impact your credit score if they’re late. However, they may impact your score negatively if you’re multiple months behind and the provider turns your debt over to collections.

2. Amount of Debt - 30%

The amount of debt you owe accounts for 30% of your credit score. That debt, also called your credit utilization ratio, is calculated by comparing how much revolving credit has been extended to you—AKA your credit limit—to how much you’ve used.

For example, if you have a single credit card with a $200 balance and a $1,000 credit limit, your credit utilization rate is 20%. It’s best to keep your overall credit utilization to 30% or less.

3. Credit Age or Credit History - 15%

Credit age affects 15% of your overall score. When it comes to the age of your credit accounts, there are two main things that a lender looks at:

- The age of your oldest credit account.

- The average age of your combined accounts—calculated by adding up the age of each account and dividing it by the number of accounts you have

As you probably guessed, the older your accounts, the more that affects—and helps—your credit score. Because of this, try to avoid closing your older accounts unless there’s a good reason to do so.

4. Account Mix - 10%

Credit mix accounts for 10% of your score. This refers to having a good mix of both revolving and installment accounts. In other words, try to have a good mix of accounts like credit cards and loans.

5. Credit Inquiries - 10%

Credit inquiries occur when someone checks your credit, and they can be either soft inquiries or hard inquiries. Soft inquiries don’t impact your credit score. A hard inquiry occurs when a lender checks your credit to see if you qualify for a loan—or not. These can bring your score down a bit, and hard inquiries account for around 10% of your credit score.

Surprising Things That Affect Your Credit Score

Seems pretty straight forward, right? Pay your car payment and credit card bill on time, keep your old credit accounts open and don’t run up your balances or apply for a bunch of loans, and your credit score will be fine. In reality, it’s a bit more complex than that. Here are a dozen specific scenarios that can impact your score negatively.

3. Reporting Errors

Similarly, unpaid utility bills can affect your credit score negatively when the debt is sold to a third-party debt collector. The third-party collector can report the account to the credit bureaus.

Some things to consider

When ever possible work to negotiate any type of debt you owe because I an be added onto your credit as a negative.

1. Medical Bills

While medical bills are treated differently by credit bureaus and scoring models, they can still impact your credit if they go unpaid. Typically, credit bureaus won’t report unpaid medical debt immediately when it’s reported to them, giving you some time to work with your insurance company and the provider to pay the bills. But eventually, unpaid medical bills are likely to show up on your report.

2. Delinquent Child Support

Unpaid child support is considered debt. And it can be reported to the credit bureaus by the municipality or agency responsible for collecting the payments.

Always Know Your Credit Score!

It is important to always know your credit score. You are entitled to 1 free credit report a year. Get A FREE Copy of our Credit Report - www.annualcreditreport.com

You can also sign up for websites like www.creditkarma.com or www.myfico.com to sign up for a credit report, and other tools that can help you monitor your credit and rebuild it.